Cash flow is the undisputed lifeblood of any business, directly influencing its operational capacity, investment potential, and overall resilience. Within this critical financial ecosystem, Accounts Receivable (AR) isn’t just an accounting entry; it’s a strategic asset reflecting your company’s future liquidity and its ability to convert sales into tangible cash.

Yet, businesses frequently grapple with the pervasive challenge of overdue payments. These delays tie up working capital, creating cash flow shortages that hinder daily operations, limit strategic investments, and ultimately stifle growth. This financial friction impacts everything from payroll to product development.

Mastering Accounts Receivable Key Performance Indicators (KPIs) and strategically managing collections are paramount for transforming your company’s financial health. By moving beyond basic definitions and embracing a strategic perspective, businesses can unlock significant value and build a more resilient financial future.

Deconstructing Key Accounts Receivable Performance Indicators

Understanding core AR KPIs is crucial for gaining actionable insights into your financial health.

- Days Sales Outstanding (DSO): This fundamental metric quantifies the average number of days it takes to collect revenue after a sale. A consistently high DSO signals inefficient collections, potential liquidity issues, and impending cash flow problems. Conversely, a low DSO indicates a highly efficient cash conversion cycle. High DSO can lead to seeking external financing, incurring interest expenses, and limiting investment in growth opportunities. It can also signal underlying issues in credit policy, invoicing accuracy, or customer relationship management.

- Days Delinquent Outstanding (DDO): DDO offers a more granular perspective by measuring the average number of days accounts receivable are past due. Unlike DSO, DDO focuses specifically on overdue accounts. A rising DDO indicates increasing collection challenges and a heightened risk of bad debt. It functions as an early warning system for broader economic downturns or internal weaknesses in credit vetting. Mishandling delinquent accounts can lead to client relationship damage and lost revenue.

Beyond DSO and DDO, other vital KPIs offer a comprehensive view of AR health:

- Collection Effectiveness Index (CEI): CEI measures how effective a company is at collecting its receivables over a specific period. A CEI closer to 100% signifies superior collection performance.

- Accounts Receivable Turnover Ratio: This ratio indicates how many times a company collects its average accounts receivable balance during a given period. A higher turnover ratio generally suggests efficient credit and collection practices.

- Bad Debt Ratio: This expresses the percentage of uncollectible accounts relative to total receivables or credit sales. A lower ratio indicates effective credit management and successful collection efforts, minimizing direct hits to the bottom line.

These KPIs are deeply interconnected. For example, a high DSO and DDO will predictably correlate with a lower CEI and A/R Turnover, and consequently, a higher Bad Debt Ratio. Analyzing these metrics holistically allows financial decision-makers to identify specific weaknesses and formulate targeted improvement strategies.

The Unseen Costs of Suboptimal Accounts Receivable Management

Failing to manage AR effectively extends far beyond mere lost revenue, incurring a range of profound, often unseen, costs.

- Impact on Liquidity, Working Capital, and Investment Capacity: Unpaid invoices tie up capital, restricting a company’s ability to meet immediate financial obligations. This lack of accessible cash can lead to cash flow shortages, hindering daily operations and limiting investment in strategic growth initiatives.

- Operational Inefficiencies and Resource Drain: Suboptimal AR management creates significant operational inefficiencies. Companies expend considerable time and effort on internal collections, diverting staff from their primary, value-generating roles. This “invisible tax” on productivity means valuable expertise is directed towards non-core, high-stress activities, hindering strategic objectives and delaying new revenue generation.

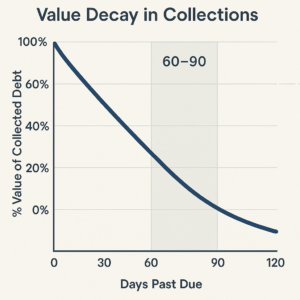

- Erosion of Profitability and Increased Risk of Write-offs: Late payments directly erode a company’s net profit. As debts age, their collectibility diminishes, increasing the likelihood of bad debt write-offs, which are direct hits to the bottom line.

- Potential Strain on Client Relationships: Aggressive or unprofessional internal collection tactics carry a substantial risk of alienating valuable customers. Losing a client over a collection dispute can be far more costly than the debt itself, leading to customer churn, reputational damage, and a reduction in Customer Lifetime Value (CLTV).

Strategic Pathways to AR Optimization and Enhanced Collections

Optimizing Accounts Receivable requires a proactive and multi-faceted approach.

- Proactive Invoicing, Credit Policies, and Communication: Effective AR management begins with clear, accurate, and timely invoicing. Establishing robust credit vetting processes for new clients can significantly minimize default risk. Consistent and professional communication with customers regarding payment terms and reminders can dramatically improve collection rates.

- Identifying the Inflection Point for Escalating Collection Efforts: Despite best practices, some accounts will become overdue. The crucial moment when internal efforts become less effective or too costly typically occurs when accounts move beyond 60-90 days past due. At this stage, the likelihood of collecting the debt through internal means decreases significantly, reflecting the “value decay” of the debt.

- The Strategic Decision: When and Why to Engage External Collections Expertise: Engaging external collections expertise should be viewed as a strategic business decision, not a sign of internal failure. It’s particularly beneficial when facing a high volume of overdue accounts, dealing with complex debts, preserving valuable customer relationships, or when internal resources are stretched thin.

The Strategic Advantage of Partnering with Commercial Collections Experts

Partnering with professional commercial collections agencies offers a distinct strategic advantage.

- Leveraging Specialized Expertise: Agencies possess deep expertise in debt collection laws and regulations, mitigating legal and reputational risks that internal teams might inadvertently incur. They employ trained negotiators skilled in advanced techniques and understand industry-specific payment behaviors.

- Driving Efficiency and Allowing Internal Teams to Focus on Core Competencies: Outsourcing collections frees up valuable internal resources—finance, sales, and administrative staff—allowing them to concentrate on revenue-generating activities and strategic initiatives. This optimizes human capital allocation, contributing to long-term competitive advantage and growth.

- Protecting and Preserving Valuable Client Relationships: Professional agencies act as a neutral third party, using tactful and diplomatic communication to maintain goodwill and the possibility of future business. This contrasts with the potential for internal teams to damage relationships through aggressive tactics. Agencies can often recover debt while preserving client relationships, transforming a potentially adversarial situation into one of mutual understanding.

- Quantifiable Improvements in Recovery Rates and KPI Performance: Professional agencies consistently demonstrate higher success rates, often improving recovery rates by up to 30%. This enhanced recovery directly translates into improved cash flow and a stronger financial position, providing the financial fluidity necessary for reinvestment and strategic advantage.

While internal collections might seem like the default, a strategic evaluation reveals that professional agencies offer a more robust, compliant, and ultimately more profitable solution for optimizing Accounts Receivable.

Conclusion

Accounts Receivable KPIs are far more than mere accounting metrics; they are vital diagnostic tools and strategic compasses for your company’s financial health. A deep understanding and continuous monitoring of these indicators provide crucial insights into your business’s liquidity, operational efficiency, and overall profitability.

In an unpredictable economic landscape, businesses aiming for sustained financial resilience must recognize that expert collections are not merely a reactive service for bad debt. Instead, partnering with commercial collections agencies should be viewed as a proactive, strategic decision. By leveraging external expertise, companies can optimize cash flow, mitigate significant financial and reputational risks, and ensure the sustained financial agility necessary for long-term success. This strategic collaboration transforms a potential liability into a powerful asset, fostering a more resilient and growth-oriented financial future.