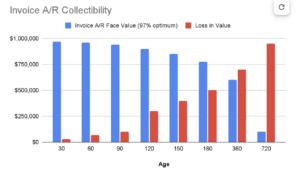

The average collectibility for B2B invoice receivables by age can vary widely depending on industry, customer base, economic conditions, and credit practices. However, a general trend can be observed in how the likelihood of collection changes over time.

The time for outside, “third-party” collection agency action is when the debt may still be collectible, best from 90-120 days past due. Waiting too long is to invite a total write-off.

Here’s a typical breakdown by age of receivables:

- 0-30 Days Past Due:

- Collectibility: 95% to 97%

- Comments: Most recent invoices are usually collected without significant issues, as they are within standard payment terms.

- 31-60 Days Past Due:

- Collectibility: 80% to 90%

- Comments: These receivables might require follow-up reminders or slight collection efforts. The probability of collection remains high but begins to decrease.

- 61-90 Days Past Due:

- Collectibility: 60% to 75%

- Comments: At this stage, the collectibility decreases more noticeably. More aggressive collection actions might be required.

- 91-120 Days Past Due:

- Collectibility: 30% to 40%

- Comments: Receivables older than 90 days are increasingly difficult to collect. This often requires significant effort or third-party collection agencies.

- 121-180 Days Past Due:

- Collectibility: 40% to 50%

- Comments: The probability of collecting these receivables is low. Legal action or substantial incentives may be necessary to recover some of these debts.

- 181+ Days Past Due:

- Collectibility: Less than 50%

- Comments: Receivables in this category are often considered highly unlikely to be collected and might be written off as bad debts.

- 360+ Days Past Due:

- Collectibility: Less than 70%

- Comments: Receivables in this category are often considered highly unlikely to be collected and might be written off as bad debts.

These percentages can fluctuate based on specific business practices, customer relationships, and economic conditions. Maintaining good credit management and proactive collection efforts can help improve the collectibility of receivables.

From the practitioners at Leib Solutions LLC, a Smyyth company