Every business cherishes its reliable, long-standing clients. They pay on time, communicate clearly, and contribute consistently to your bottom line. But what happens when these “good clients” start to falter? When late payments become the norm, excuses pile up, or communication suddenly stops?

It’s a scenario many businesses dread, and one that often signals more than just a momentary oversight. It can be a tell-tale sign of deeper financial distress within your client’s own operations. Missing these subtle cues can lead to significant revenue loss, strained relationships, and a draining of your internal resources.

At Leib Solutions, we believe in a proactive, ethical approach to accounts receivable management. Understanding the financial health of your client portfolio is not just about protecting your own cash flow; it’s about anticipating challenges, fostering resilient partnerships, and making informed decisions. This post will equip you with insights to spot those early warning signs and guide you on how to respond strategically and ethically.

The Subtle Shifts: Early Warning Signs to Watch For

The first indicators of financial trouble are rarely a dramatic collapse. Instead, they often manifest as subtle deviations from established patterns. Training your team to recognize these changes is crucial.

1. Shifts in Payment Behavior

This is often the most direct, yet sometimes overlooked, signal.

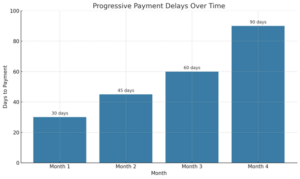

- Increasing Payment Delays: A client who once paid consistently at 30 days suddenly pushes to 45, then 60, then 90. It’s not just a single late payment, but a growing trend of tardiness.

- Partial Payments: Receiving only a portion of the outstanding invoice without prior agreement. This can be a tactic to string out payment or manage limited cash flow.

- Frequent Payment Disputes: Suddenly, old invoices are being disputed for minor issues, or new, vague “concerns” arise that delay payment. This can be a deliberate stalling tactic.

- Requests for Unconventional Payment Terms: A client accustomed to standard net-30 terms now requests installment plans, extended terms, or asks to pay in atypical ways (e.g., through third-party services they didn’t use before).

- “Check’s in the Mail” Syndrome: Repeated promises that payment is “just about to arrive,” followed by no actual payment.

2. Communication and Operational Cues

Beyond the numbers, how your client interacts and operates can offer valuable insights.

- Communication Avoidance: Your calls or emails to key contacts in their finance or procurement departments go unanswered, or responses become evasive and non-committal.

- Reduced Order Volume/Frequency: A significant and unexplained drop in the quantity or regularity of orders from a previously reliable client. This could indicate a slowdown in their own business or a shift to cheaper suppliers.

- High Personnel Turnover: Especially in their finance, procurement, or upper management. This can signal internal instability or a scramble to cut costs.

- Increased Vendor Shopping: You notice your client suddenly soliciting bids from numerous new suppliers, even for services or products they previously sourced exclusively from you. They might be desperately searching for lower costs.

- Complaints about Their Own Clients: Hearing from them about their struggles to collect from their customers. While this can elicit empathy, it also indicates their own A/R challenges.

3. Public and Market Indicators

These require a bit more proactive monitoring but can provide macro-level insights.

- Negative Public Perception: Unfavorable news articles, negative social media chatter, or a sudden downturn in their public reputation.

- Industry Downturn: Being aware of broader economic challenges or specific trends impacting your client’s industry. If their sector is struggling, they likely are too.

- Layoffs or Restructuring Announcements: Public statements about workforce reductions, significant operational changes, or a merger/acquisition that seems like a distress signal.

- Changes in Commercial Credit Ratings: While not always publicly accessible, a significant drop in their credit score from agencies can be a strong indicator of rising risk.

The Responsible Response: Navigating Difficult Conversations

Spotting the signs is just the first step. How you respond can significantly impact your recovery rates and, crucially, the long-term health of your business relationships. The key is to move from a reactive, accusatory stance to a proactive, empathetic, and strategic one.

- Internal Alignment: Ensure your sales, accounts receivable, and management teams are on the same page regarding the client’s status and the chosen response strategy. Inconsistent messaging can erode trust.

- Proactive and Empathetic Outreach:

- Shift the Tone: Instead of immediately demanding payment, initiate a conversation with an empathetic tone: “We’ve noticed a recent change in payment patterns, and we wanted to check in to see if everything is alright on your end and if there’s anything we can do to help.”

- Listen Actively: Be prepared to listen more than you talk. Your goal is to understand their challenges, not to preach.

- Offer Solutions (If Appropriate): If their distress is temporary, can you offer a short-term, mutually agreed-upon payment plan? This gesture can build immense goodwill.

- Maintain Professionalism: Regardless of their situation, always communicate with respect and professionalism.

- Document Everything: Meticulously record all communications, agreed-upon terms, and payment promises. This is vital for clarity and, if necessary, for any future recovery efforts.

- Know When to Draw the Line: While empathy is crucial, a business must protect itself. There comes a point where continued forbearance becomes detrimental. Establish clear internal thresholds for when to transition from a supportive partner to initiating a more formal collection strategy. This line is often blurred for internal teams, which is where external expertise becomes invaluable.

When Internal Efforts Fall Short: The Strategic Role of a Specialized Partner

Even with the best intentions and internal protocols, managing a financially distressed client can be incredibly challenging. This is where the specialized expertise of a commercial collections company like Leib Solutions becomes a strategic asset.

- Objective Perspective: Your internal team has existing relationships and may be emotionally invested. A third party brings objective distance, allowing for clearer, more effective negotiation without damaging long-term ties.

- Relationship Preservation through Professionalism: Our “No Noise” approach is specifically designed to recover funds while minimizing friction and maintaining the viability of your client relationships. We act as a professional buffer, allowing you to focus on your core business.

- Specialized Expertise and Resources: We possess the legal knowledge, negotiation acumen, and advanced tools to navigate complex financial situations. This includes understanding the nuances of commercial law and effectively managing disputes.

- Efficiency and Focus: Engaging an expert allows your internal A/R team to focus on current accounts and healthy relationships, significantly reducing administrative burden and freeing up valuable resources.

- Improved Recovery Rates: Often, early engagement with a specialized agency, even at the first signs of trouble, can lead to significantly higher recovery rates than prolonged internal efforts. Our experience helps us assess the true likelihood of recovery and implement the most effective strategies.

Recognizing when a good client is heading down a difficult financial path is a critical skill for any business. Acting ethically and strategically, whether internally or through a specialized partner, protects your cash flow, preserves relationships, and ultimately strengthens your overall financial resilience.

Ready to Proactively Safeguard Your Accounts Receivable?

If you’re noticing these warning signs in your client portfolio and are seeking an ethical, effective partner to navigate complex financial challenges, Leib Solutions is here to help.

Contact us today for a confidential consultation.