All businesses face cash flow issues during challenging economic climates, making it especially difficult to collect customer payments within the agreed-upon terms. To optimize your collection efforts and cash flow, it is essential to reevaluate the priorities of your collection department, including the utilization of third-party collection agencies. Making timely referrals to these agencies for bad debts can significantly improve collection results while minimizing unnecessary costs.

Is Using an Agency a Collection Failure or an Integral Part of the Process?

- Needing a collection agency does not represent your department’s collection failure, as a certain percentage of all customers are destined to fall into this category regardless of how hard to try to collect.

- When your collector staff exhausts their efforts without yielding results, there comes the point of diminishing returns. In such cases, a timely collection referral can be a victory for your company.

- Holding onto past-due accounts for extended periods diverts your staff’s attention from high-priority customers and balances, which are more profitable. Continuously pursuing payment from those who consistently fail to pay is an unproductive use of resources.

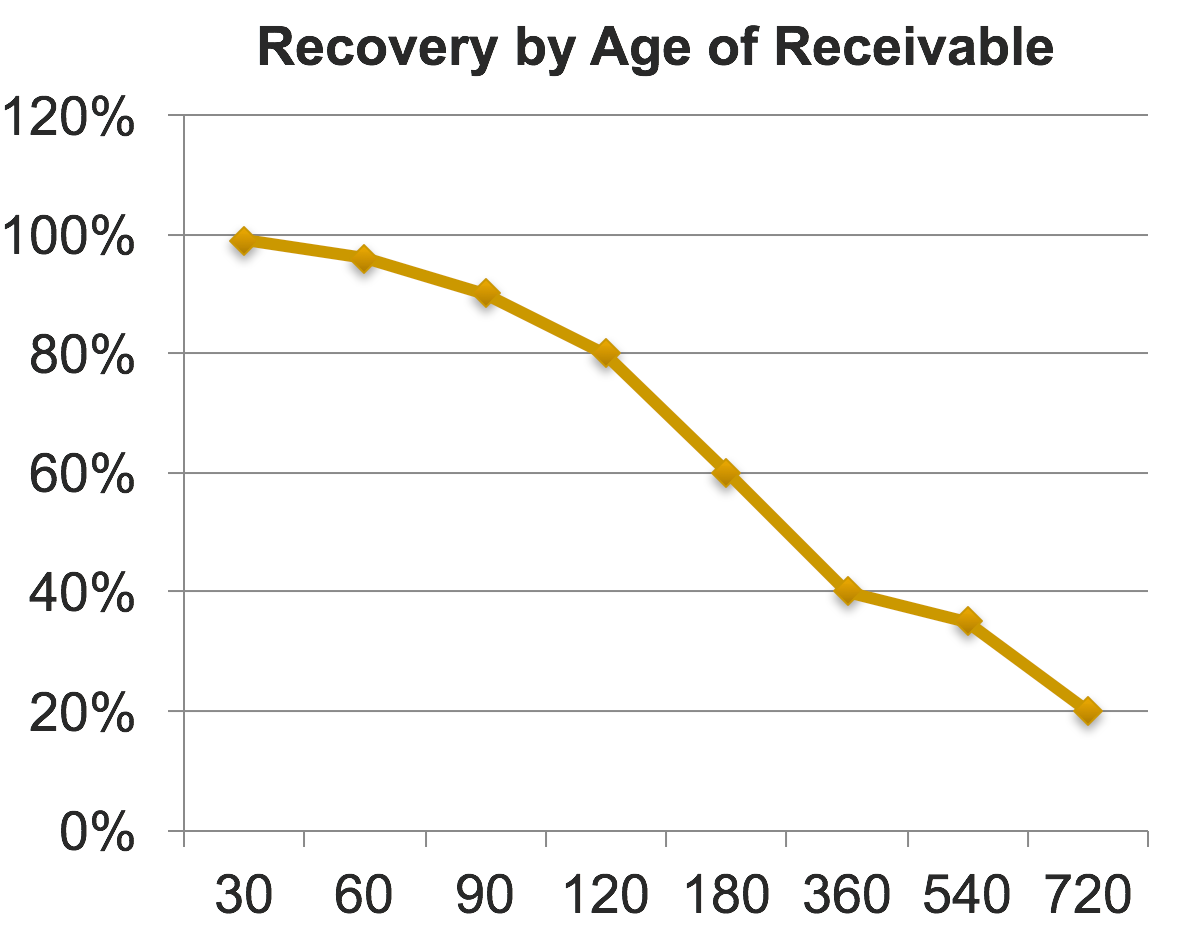

- By allowing collection agencies to handle difficult cases, your internal collectors can focus on where the cash comes from rather than being tied up with long overdue unpaid balances. The longer an account remains past due, the more challenging it becomes to collect. Collectability decreases each month to the extent that after nine months, the likelihood of collection may be close to zero.

Important! Your past-due customers will seek other suppliers and you will lose business if you do not collect. Consequently, integrating timely collection agency referrals into your collection process is essential.

Considerations for Collection Agency Placements:

- Utilize your internal resources for accounts 10 to 90 days past due, as they contribute 95% of your cash flow and offer a high return on your time investment. Allow your staff to focus on the accounts receivable that keep your business running.

- Waiting beyond 90 to 120 days and hoping for collection before referring the account to a collection agency is counterproductive. Timely interventions are more likely to succeed.

- Assigning accounts to a collection agency immediately grabs customers’ attention as they realize that the unpaid debt could negatively affect their credit bureau scores.

- Collection agencies charge fees based only on the cash recovered, and a reputable agency increases the chances of successful collection.

- The agency can tailor their collection tactics, employing a customer service approach when you hope for future business and a more assertive approach for chronic late payers.

When is the Right Time to Refer a Debt for Collection?

Consider the following five factors before deciding to refer a customer to a collection agency:

- The account is 90 days late.

- The customer has failed to follow through, broken a promise to pay, or become difficult to reach.

- The customer has indicated financial difficulties.

- Remember that your customers prioritize their cash payments, and they pay those who have taken more aggressive actions or whose products they need. You have become a low priority and will lose future revenues if you do not collect.

What to Look for in a Collection Agency:

When selecting a collection agency, keep the following eight factors in mind:

- Membership in a professional organization such as the International Association of Commercial Collectors (IACC) upholds a strict code of ethics and legal compliance.

- Agencies specializing in either B2B or consumer collections. Collecting from businesses is more challenging and requires specialized expertise. If you have commercial debt, choose a commercial bad debt agency.

- A well-established track record, having been in business for many years.

- The ability to communicate with the agency’s management before initiating business and during the collection process.

- An excellent history of collection results and adherence to market-standard contingency fees.

- Strong reviews, such as positive feedback from clients on platforms like Google, indicate trustworthy and quality relationships.