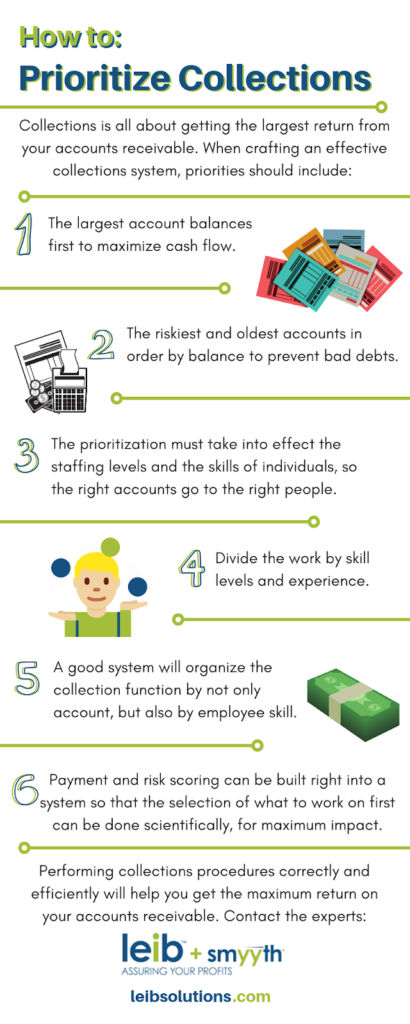

The basis of our accounts receivable management services is the prioritization of collection activities around the money and the priorities instead of an “alphabetic order” type of collection effort.

1. Create a Plan of Action using situational strategies based on the accounts and circumstances, but remember that measuring collection metrics is not the same as following the strategy.

Collection Strategy and Corporate Goals. Even if you do not have a modern collaborative collection system, you can still incorporate many elements into your manual process.

- Manual collection processes and spreadsheet collection management are very inefficient and ineffective, very low productivity, and error-prone.

- Your process should require you to think about and choose collection “strategies” (vs. the usual A-Z collection approach) which will create an environment where performance matches the corporate objectives for cash flow.

- Your process should incorporate an easy-to-modify “rules-based” action driver that takes into consideration your corporate objectives and policies and manages collector activity and priorities. It also will adjust collector actions based on changes in customer risk.

- It should support simple-to-assign alternative collection strategies, or a combination of strategies, depending on the collection staff expertise and customer risk categories.

- “Risk Scores” strategy, attending to the riskiest customers first to avoid bad debts.

- “Payment Scores” strategy, using your historical payment information to re-train customers payment habits.

- “Payment Gap” strategy, which benchmarks your customer aging against your industry to (ask Smyyth for more information on this).

- “Cash Goal” strategy to focus on maximum cash goal for a month or quarter, which could mean focusing on the largest dollars regardless of age.

- “Delinquency Reduction” strategy, which focuses on reducing the number of accounts past due aging buckets.

Workflow. System rules should establish workflow, as well as escalation to management, which will change according to the circumstances, age, number of collection calls, etc. A collection strategy can include (automatic) collection call reminders, system collection emails, letters,etc., all determined based on what the result of the last action was and a timetable. For example, if the customer made a promise to pay, the system should generate an email confirming it, and then set up an automated follow-up on the appropriate day.

Standard Documents Library. Not only can all collection documents can be standardized and then customized if needed, but also automatically transmitted. Letter campaigns, for example, can be outsourced to mailing companies, without any manual intervention.

2. Prioritize Collection activities by size and risk, and around the resources and time available to do it, for the biggest return. Whether this is controlled by your collection system (the best way) or by manual ledger review, the priorities would include:

3. Monitor all accounts receivable at least on a weekly basis and follow up on those customers when due, or in the case of very large invoices, a few days ahead of the due date as a friendly reminder to them that it is important to you.

4. Define Responsibilities and roles of the collection department around skills

- High volume, quick-hit collectors

- Complex account collectors

- Final demand – tough collection negotiators

- At what point are accounts “escalated” to a higher level

- Dispute resolution specialists

5. Schedule your calls by time zone, and try to catch decision makers earlier or later than you would accounts payable department. Note: west coast companies often start at 8AM.

6. Quickly Resolve Disputes .The timely management of invoicing problems and disputes can make a dramatic difference in your ability to collect outstanding balances, as it can affect your customer relationships.

Our Best Practices

While this blog does give you a detailed rundown of what we find to be collections best practices, sometimes you can’t do it on your own. When you’re looking for AR outsourcing that produces results, turn to the experts at Leib Solutions.