Insurance executives are familiar with subrogation, the insurer’s legal right to pursue damages after paying a claim. However, it turns out that many insurers are unable to or neglect to pursue their subrogation rights. If they do, they may not be using best practices in doing so. This results in profit opportunities lost forever, as well as inefficiency and excess overhead expense in the recovery effort. In both ways, it hurts insurers’ profits.

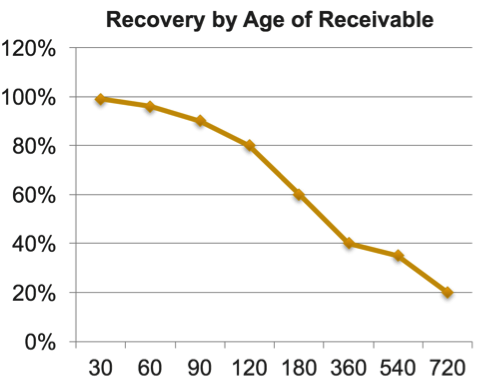

Every dollar of subrogation you capture goes to the bottom line, and every dollar that ages out and gets written off is profit lost forever.

Focus

Subrogation is an integral part of the insurance process – not an afterthought – and should be managed as such. It is worth millions or even tens of millions of dollars in profit opportunity. When a subrogation recovery function is optimized, it can have a material effect on the insurer’s operating ratio.

Perhaps as much as $1 of every $4 paid in claims can be recovered through subrogation. Many, perhaps 1/3 of all potential claims, are never handled at all, representing a unnecessary revenue loss.

This area is a huge opportunity for every insurance company and requires a greater level of focus and management (or expert outsourcing) in order to capture the opportunity.

Processes and Systems

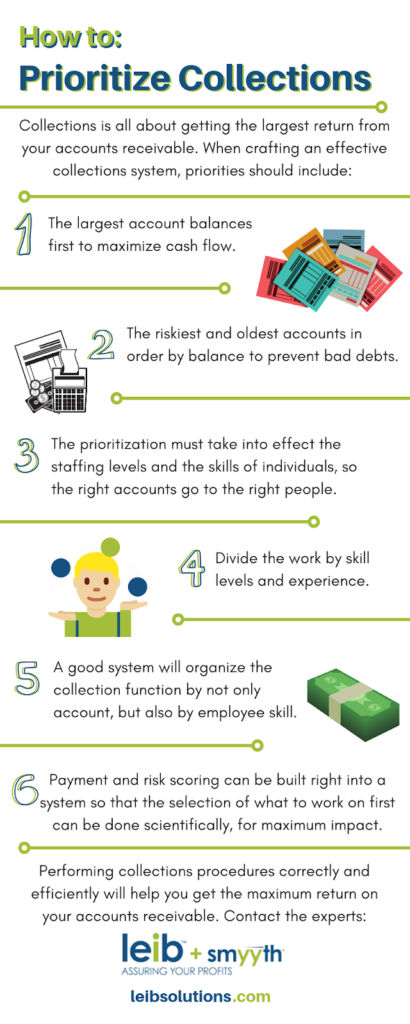

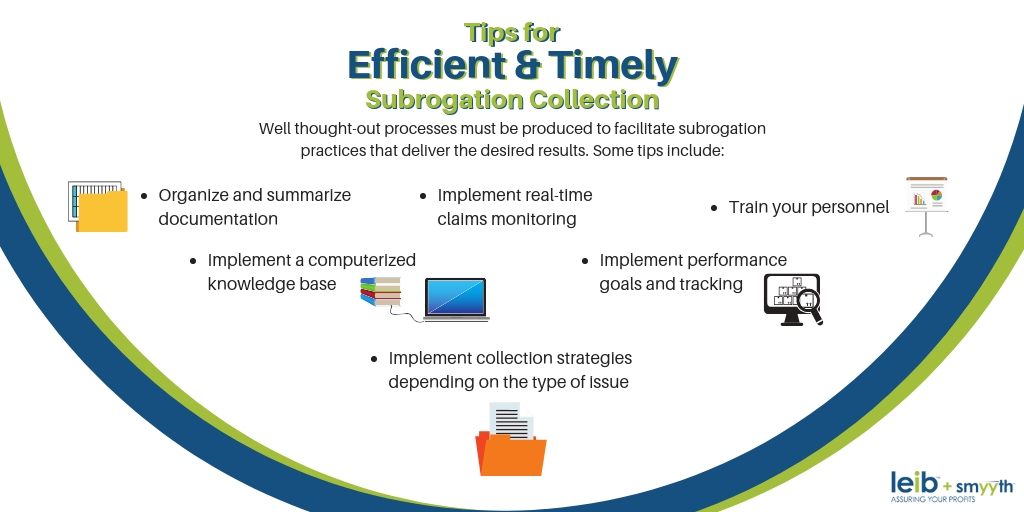

Clear and well thought out processes must be developed so that the subrogation effort is efficient and timely, and produces the desired results. There is too much money involved to ignore this process. This includes well-crafted demand letters. Here are some quick tips:

Documentation

Documentation must be secured and organized for quick analysis of the potential. If there is a lot of money involved, it may be helpful to check to see if the party from whom you are attempting to collect has the funds before you invest too much in the recovery effort.

Systems

You need smart systems to track claims, their status and all collection/resolution activities. A collaborative system is the key, since you should be able to escalate a case internally or for additional input or advice. This system should include automated workflows, follow-up protocols guaranteeing that no claim ever slips through the cracks, and automated claim communications. A plus would be the ability to push a button to assign a claim or category of claims to an outsourcer/agency, and continue to track the results through your system.

State of the art web-based software, such as that used by Leib Solutions, includes all this, plus uses robotic processes that replace repetitive and error-prone manual work with automated error-free and on-time solutions.

Tips

- Re-engineer processes from beginning to end

- Automate systems eliminating repetitive tasks

- Install management oversight dashboards

- Have a collaborative system so that resources throughout the company can be accessed according to the circumstances.

- Use performance tracking

The system, of course, should track the performance of individual subrogation analysts with concise management reports. You will find that in a staff of ten, the success rate can vary wildly, with some more than twice as effective as others. Smart performance reporting can identify areas of success or weakness; it should be used to initiate a virtual feedback loop and training for staff.

Statute of Limitations

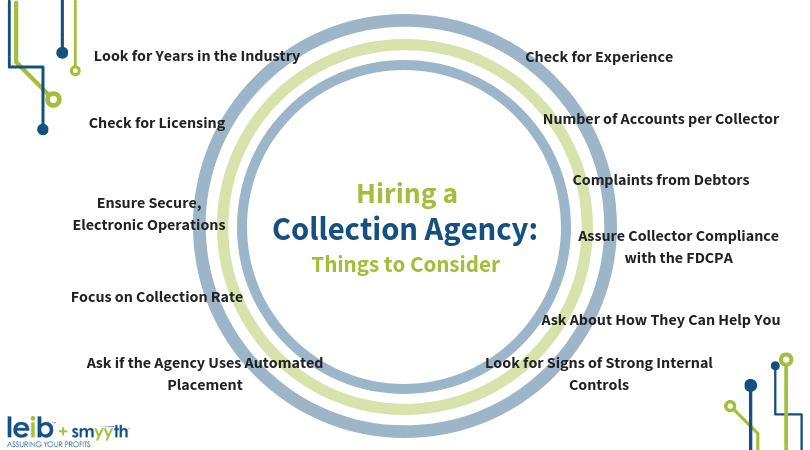

While a majority of states allow subrogation claims for either two or three years, or even longer, after the incident, there are a few that allow only one year so you need to aware of state laws in this regard. Allowing subrogation claims to age out so far – which many insurers do – is a bad practice on all accounts and will reduce the ultimate recovery. If you can’t get to them all promptly, by all means outsource collection to an agency.

First-Party Payments

When making first-party claim payments, you will need to prove that the amount paid was reasonable and well documented. It’s on you to prove the payment was appropriate. Further, you cannot recover Replacement Cost, even if you paid it, only Actual Cash Value.

Advise of Subrogation

Advise the insured as soon as possible that you are going to pursue subrogation to preclude them taking actions which may hurt your case, as well as to elicit their cooperation. Early notice should also be given to your insurance counterpart, along with documentation supporting your case. The faster you start the process, the sooner you will achieve a successful outcome.

“Tort” Vs “Debt”

A subrogation claim is generally considered a “tort” – not a “debt”, so it has been found by the courts as not subject to the FDCPA. This is important as defendants have in the past tried to use assertions of FDCPA violations as a potential hammer against collectors. Note: there are some state laws that go contrary to this. It’s important you have this knowledge so you can protect yourself.

Expansive Rights of Insurer

Remember that you have all the rights of your insured against responsible third parties, even if those rights are contractual rather than founded on tort law.

Lawsuit vs. “Amicable” Resolution

The expense of litigation should give one pause. Sometimes lawsuits (or the threat thereof) are required. However, claims most often remain unresolved because of lack of attention and the inability to give the issue the time and focus needed. That is where an agency comes in.

Conclusion

Subrogation claims come in all sizes and varieties so you have to balance the potential recovery vs the amount it costs to get it. This is called the “netback”; how much do you end up with after labor, agency or attorney costs. If you engage a professional agency, the expense may (or may not) be higher, but the old saw applies: 65% of something is better than 100% of nothing.

However, every insurer has limited expert resources, so the more time you spend on any function (such as subrogation) that is tertiary to the core mission, means less time spent elsewhere. Frequently, we find that when subrogation issues get less attention than they need and require, they age out and become more difficult to resolve as a result.

In addition, complex disputes such as subrogation are hugely expensive to handle; often on average hundreds of dollars per claim. Managing subrogation is a balancing act, and this is where an experienced outside agency can be very helpful.

Fortunately, there are professional organizations such as Leib Solutions that enable you to cost-effectively outsource subrogation claims and accounts receivable management services. What Leib offers include:

- Expert staff

- Maximum recoveries

- Top customer service

- Commission based on results vs. overhead expense

- State-of-the-Art collaborative collection technology

- Client performance dashboards

- Legal forwarding (when required)

Please contact us for more information on all of our AR outsourcing services.

The Revenue Cycle Function requires excellence in four key areas, each contributing to a company’s success and operational efficiency. Recognizing these focus areas will allow your company to generate a frictionless revenue cycle flow and improve your cash flow, customer service, and overall profitability. When providing B2B collection services for your business, Leib Solutions makes sure to take each of these factors into account to deliver you the best possible ROI.

The Revenue Cycle Function requires excellence in four key areas, each contributing to a company’s success and operational efficiency. Recognizing these focus areas will allow your company to generate a frictionless revenue cycle flow and improve your cash flow, customer service, and overall profitability. When providing B2B collection services for your business, Leib Solutions makes sure to take each of these factors into account to deliver you the best possible ROI.