Eliminate Collection Gridlock to Reduce Bad Debts

Frauds are rare. If you perform an easy credit check, you will have very few out-and-out scams, which we’ll define as businesses that order your products, knowing that they will never pay you. The odds of getting your money in these cases is nil.

Chronic Slow Pays. The many persistent slow payers require constant attention, so they do not age-out to the point you consider them bad debts.

If you allow customers to pay very slowly, they will order more product from your competitors rather than have to catch up. If ignored too long, they will become your “uncollectible” or “bad debt” losses.

Train Your Customers To Meet Your Expectations

Train chronic slow payers to avoid bad debts (and get future sales) by (1) starting your collection efforts at the due date, and (2) if not paid after 90 days of pursuit, assign the debt to a collection agency. While this collection schedule might seem aggressive to some, it is the only way to avoid the otherwise inevitable losses. Plus, if you outsource the problem accounts to an agency, you can focus on current, higher-value accounts receivable.

A reality check. Many collection departments allow small debtors, and sometimes big ones as well, to get quite old due to lack of staff or focus until they are months past due. On top of that, they often then sit in limbo for months more to avoid recognizing a bad debt or making a decision.

The Big (non) Secret to Reducing Bad Debts:

Don’t let accounts get so old before assigning them to a collection agency.

If you act quickly, you will collect your money more often than not. If you delay, you will more than likely write off 50-100%. The following two scenarios are constant frustrations to collection agencies, and for good reason:

A creditor holds back accounts until they are so old that they are uncollectible.

A creditor delays placement worrying about the collection fee instead of the amount that could be recovered, and they end up with a 100% loss instead.

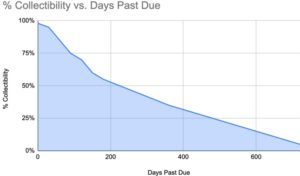

Collectibility Decreases With Age

You already know this, but this chart is an excellent reminder to address slow pays more quickly.

Not every debt is collectible, but, on average, it is 200% more likely to be collected if assigned at 90 days vs. 360 days.

Avoid Collection Gridlock with a Collection Policy

The best way to avoid debt-placement gridlock and the resulting losses is to establish a written company collection policy, and stick to it. Here’s a simple example:

Collection action for accounts in the small account risk category will commence as follows:

- 10 Days past due: A collection email #1 when the account is 10 days past due.

- 20 Days Past Due. If the customer has not responded or made a promise to pay and followed through on it, a second call will be made, with email #2.

- 30 Days Past Due. This communication will advise the customer we need payment in 15 days or we will have to hold orders. This will be reinforced with email #3.

- 60 Days Past Due. The account is escalated to the manager, who will make a “final demand” before placement with a collection agency. Email #3.

- 75 Days Past Due. If no satisfactory resolution, Certified Letter #4 will be mailed,

- 90 Days Past Due. the account is placed with the collection agency.

Fast Quiz Conclusion

Is Scenario A or B more likely to avoid bad debt?

- “This account is uncollectible. Let’s turn it over to a collection agency”.

- “This account is aging and not paying. Let’s turn it over to a collection agency before it is uncollectible”