Manual collection processes, including the many companies that still use spreadsheets to aid the process have performance problems, including very low productivity, errors, and poor cash collections.

Perhaps the best investment you can make is licensing an advanced SaaS system which will give you the structure to implement real discipline in your collection operations. It will improve cash flow, reduce bad debts, eliminate manual work, and slash overhead. An example of this would be Carixa™.

If you think your accounting system offers the necessary features to boost your cash collection results, you had better look more closely. If you believe, as our B2B collection agency does, that collections are a “production” function, it needs a production engine.

Features of an Effective Collection Software

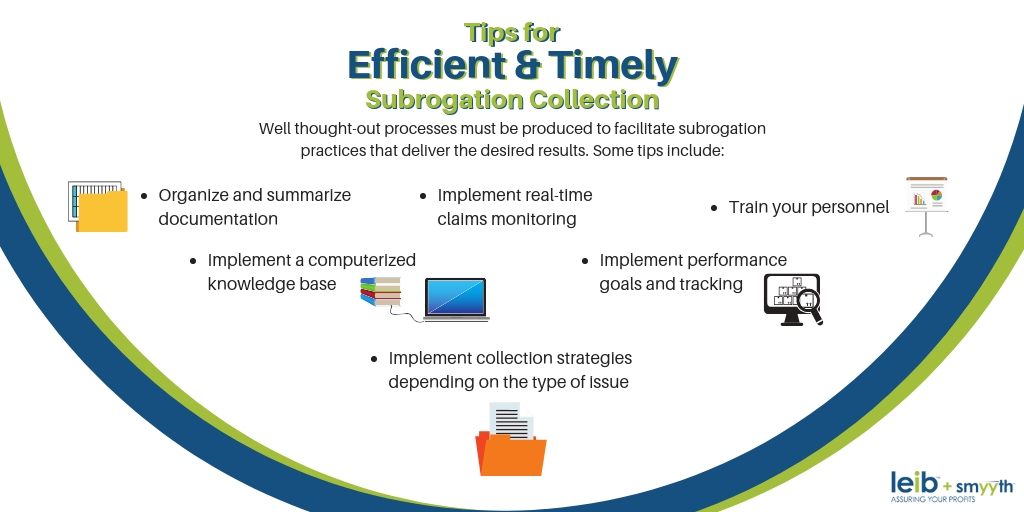

A great SaaS collection system incorporates best practice policies, business rules, scripts, contacts, escalations, automated letter campaigns, and workflows into the collection process.

Just as you should not do business without a CRM system to manage customer relationships and sales follow-ups, in today’s business environment you simply cannot get by without a collection management system to manage your cash flow.

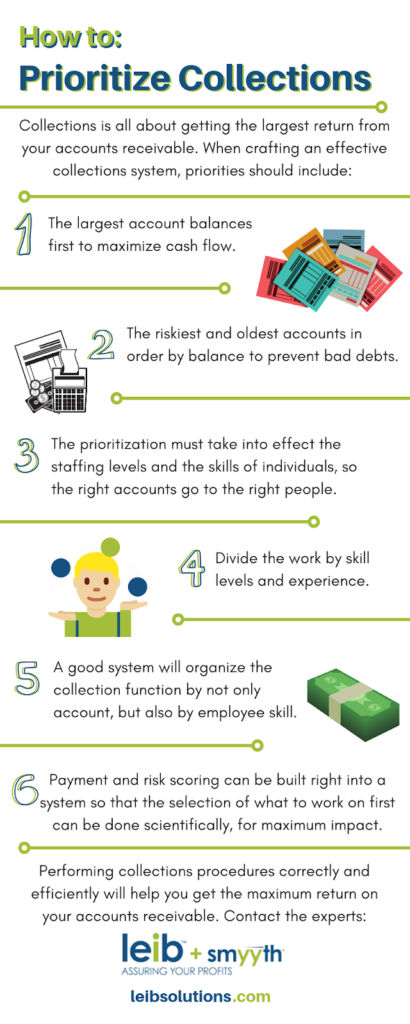

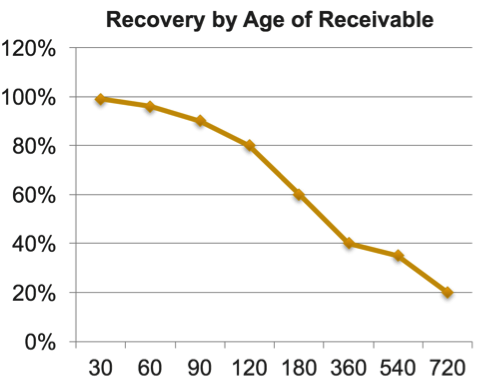

By implementing automated workflows, companies can unlock cash, reduce bad debts, and improve customer service with greater visibility. A good system can also prioritize collections for more targeted collections.

By implementing a collaborative accounts receivable workflow system such as Carixa any customer facing staff can initiate a solution for payment, deduction, dispute, or credit-related problems rather than delaying action with callbacks and emails.

Using a system for timely identification and validation of disputes and deductions, the process must include timetables, routing of collection problems and deductions, and management escalation for serious issues. Tracking of collections and deductions with a robust deduction system will provide valuable insight on gaps in compliance or service levels versus customer expectations — particularly useful in identifying systemic, recurring problems.

Use a collection system that can adapt to your policies and use credit and payment scoring models to trigger workflow actions; for example, which customer segments should be a priority, and at what point should you commence collection action? The scores should reflect credit risk, industry payment data, as well as your own experience with a customer.

What You Can Accomplish

With the right system, you can initiate all actions automatically based on a customized workflow

timeline that details specific action steps for the identification of delinquent accounts based on

customer credit rating/payment histories or customer risk class. This allows you to manage the company’s accounts receivable investment more efficiently. You should look for a system

that:

- Can handle all categories of transactions online, without resorting to offline manual activities or patches. If you need Excel downloads, it’s the wrong system.

- Incorporates your business policies and best practice rules for standardized process.

- Offers a collaborative resolution platform for employees, partners, and customers.

- Offers customized workflow, so every transaction is handled by the right person at the right time.

- Incorporates both credit and payment scoring, so your staff works the priorities.

- Drives credit and collection department “production” so that your investment in people delivers the results you need.

- Has detailed audit and reconciliation tools built right in, vs. using Excel offline.

- Provides a 100% cash application hit on the most complex receivables, while automatically initiating deduction and dispute transactions.

- Has features that provide automatic access to customer data and documentation over the web.

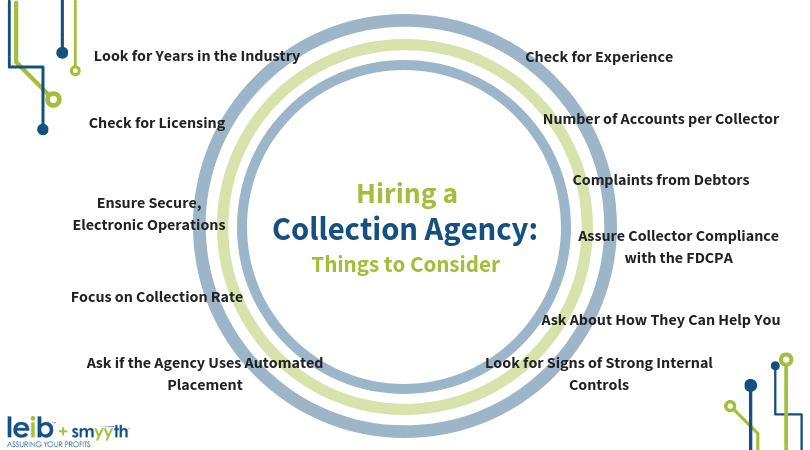

- Can seamlessly work with outside agencies and services.

- Empowers management with a reporting window into performance and daily operations down to the customer level.

- Is Software as a Service (SaaS) so it can be implemented quickly, with no hardware or software to purchase.

Outsourcing Your Collections

At Leib Solutions, we provide B2B collection services for companies whose collections are too much to handle for an in-house team. We’re a top-rated collection company trusted by businesses around the world.

Ready to generate more working capital for your business? Contact us today for a free consultation.