Every company needs a collection agency, since there will always be customers that default or who will not pay under the normal terms. Here are some ideas for your consideration when choosing an agency.

- If you are B2B you must select a “commercial” bad debt collection specialist, as they have experience dealing with corporate debt matters, bankruptcies, and their collection approach is more specialized. A good commercial agency may only assign 400-600 accounts per collector, since a more consultative collection approach is needed. A “consumer” collection agency may assign a couple thousand accounts to each collector, and are often “dial for dollars” call-center operations using collectors with, little experience.

- Every collection agency will receive complaints from debtors – it’s just part of the business. If you see there are too many, or complaints of unethical practices, look elsewhere.

- Most business debts fall into the same categories of reasons for non-payment, including:

-Cash flow problems

-Disputes on pricing or product to be worked out

-Confusion on contracts or documentation

-Client failure to follow-up frequently enough

However, if your business is not the typical commercial transaction (insurance, subrogation, on-line services, etc.), check to see if they have experience in what your line of business. - It’s very easy to get into the collection business, so to feel comfortable you should be focusing on companies that have been in business for 10 or more years.

- Agencies in most states must be licensed and / or bonded. In the end, everything comes down to character, so check out the management of the firm. If they are not shown on the web site, move on.

- A good collection agency will have strong internal controls and operating procedures to insure high quality results and customer service. This includes recording all telephone conversations for both staff training as well as compliance with collection regulations.

- If your internal staff needs in-house training to motivate and equip your collectors, the agency might have the resources to help, so ask.

- Although the Fair Debt Collection Practices Act (FDCPA) relates to consumer collections, not B2B, the agency should have their collectors trained to comply, since there are times when a commercial debt might morph into one with consumer attributes.

- If they have association accreditations it is a good sign. Leib, for example, is a member of numerous industry associations, and also has been awarded an A.M. Best Expert Service provider badge for seven years running.

- If you place only a few accounts, the method of placement and reporting is not an issue for you, but if you are a large organization, you need a firm with secure electronic placement, communications, and web-based reporting to streamline management.

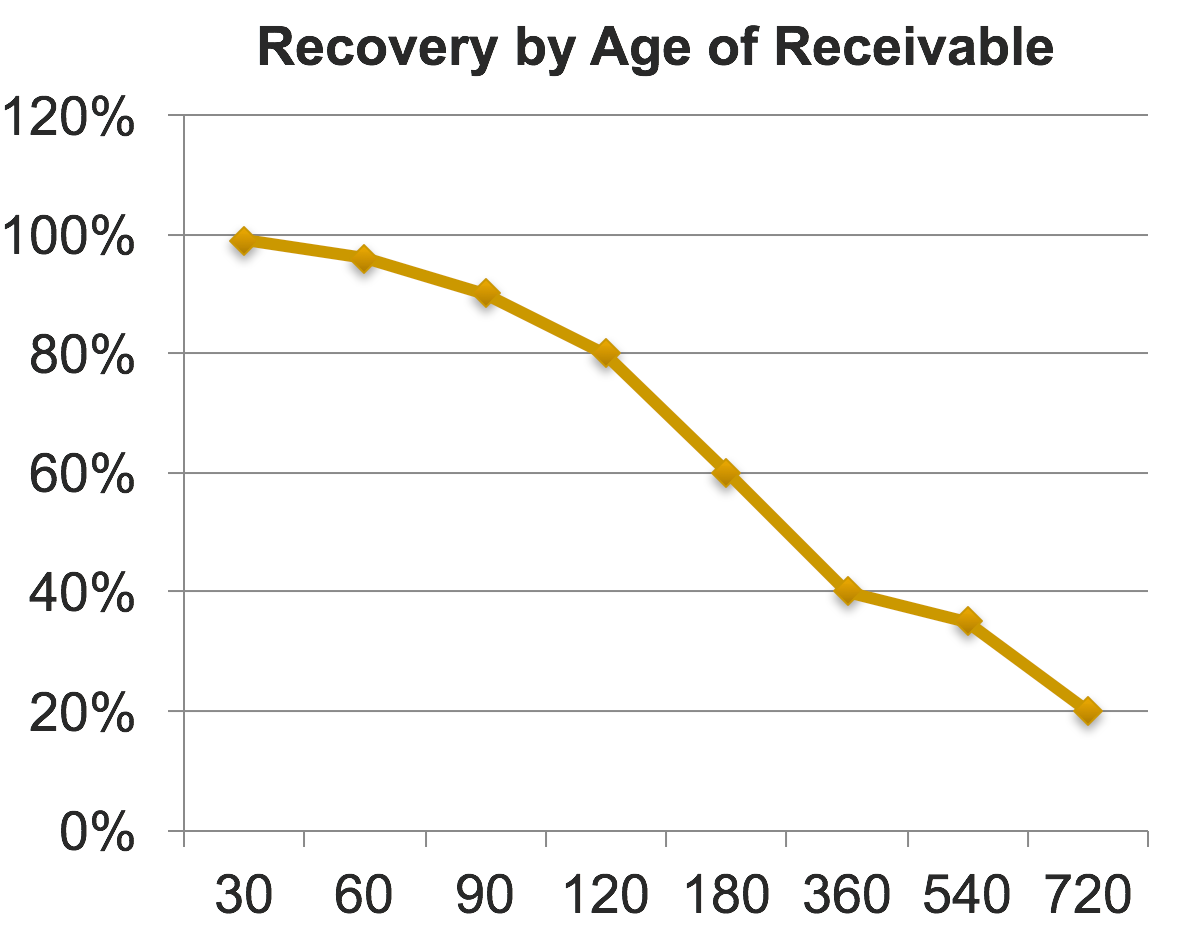

- The age at which accounts are placed for collection is an important predictor of collection success. All too often, companies will hem and haw, hoping something will happen, and let a debt languish because they do not want to pay 1/3 of the amount to collect it, and by the time they contact an agency, the debtor may well be out of business, or beyond hope.

- Always focus on the successful “net-back” – the cash you get back, and not what you are going to pay the agency. It’s better to recover most of the bad debt, rather than take a total loss.

- The most successful companies use automated placement by established time-parameters, to avoid uncertainty, and to keep collectors focused on the current accounts. With this method, you decide in advance at what age you will assign accounts to an agency, and stick to it. Ninety (90) or 120 days is a good starting point for this. Wait much later, and the collection value declines precipitously.

- First party collections. You want to select an agency with the both the technology and experience to handle “first-party” collections (using your name, as invoices come due, or special projects) to give you operational flexibility. This requires the ability to quickly and simply exchange information between their systems with yours, to keep both up to date. Leib uses the remarkable Carixa Credit-to-Cash Platform for this. The system is collaborative, giving the client a view and opportunity to participate in solving problems.